1902 Indian Head Penny Value Explained: What Collectors Actually Pay

The one-cent coin minted in 1902 represents a part of the mass production "Indian Head" series released by the Philadelphia Mint.

Total mintage reached 87,374,704 specimens, ensuring high survival rates for coins in low and medium conditions.

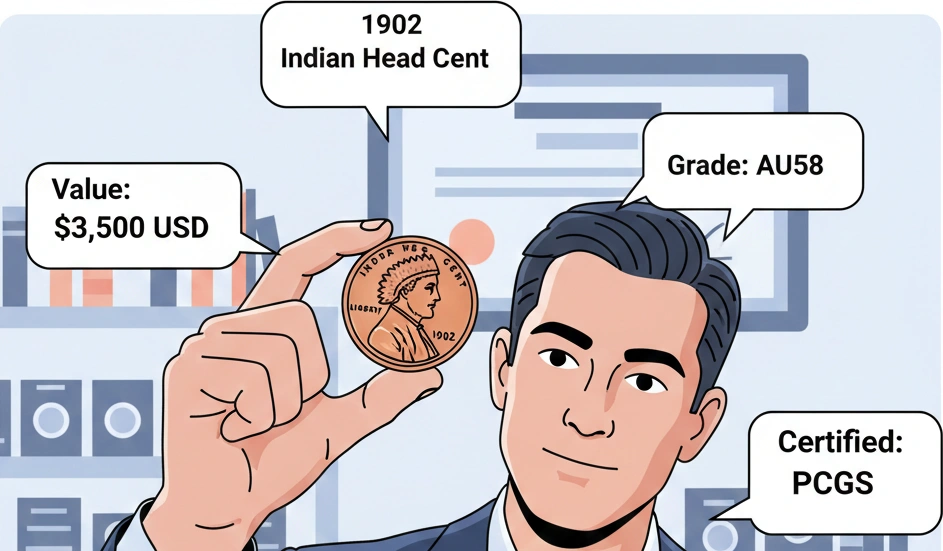

Determining the market 1902 Indian Head Penny value of this asset requires analyzing color classification and the accuracy of grading on the Sheldon scale.

The 1902 coin was struck without a mint mark, possessing standard physical characteristics for bronze issues of the late 19th and early 20th centuries.

Weight deviations exceeding 0.15 grams may indicate a counterfeit or significant electrochemical surface corrosion.

Parameter | Technical Value |

Metal | Bronze (95% copper, 5% tin and zinc) |

Weight | 3.11 grams |

Diameter | 19.00 mm |

Thickness | 1.47 mm |

Mint | Philadelphia (no mint mark) |

Lacking a mint mark on the reverse under the wreath is standard for all 1902 issue centers.

Classification of Red, Red-Brown, and Brown

Copper surface color serves as a determining factor in forming a market premium.

Professional market participants utilize three categories for dividing lots based on visual characteristics.

Brown (BN). A surface having changed color entirely resulting from natural oxidation.

Such specimens are valued minimally, constituting the bulk of coins available on the market.Red-Brown (RB). A surface having preserved between 5% and 95% of the original red luster.

Prices for these coins demonstrate stability, having moderate demand in grades from MS63 to MS65.Red (RD). A surface having preserved more than 95% of the initial mint luster.

Specifically, these specimens record the highest payments at auctions.

The price difference between the BN and RD categories in an identical MS65 grade can reach 250% or more.

Actual Payments for Circulated Conditions

Most surviving 1902 coins possess wear marks caused by active circulation in the early 20th century.

Below are the average transaction prices for coins lacking certification.

Good (G-4): Valued at 1.50 – 2.50 USD.

Very Good (VG-8): Realized at 3.00 – 4.50 USD.

Fine (F-12): Costing 6.00 – 8.00 USD.

Very Fine (VF-20): Sold in the 12 – 18 USD range.

Extra Fine (EF-40): Valued at 25 – 45 USD.

Prices for circulated coins have remained static over the past five years, showing growth of less than 1% annually.

Auction Indicators for Mint State (Uncirculated)

Investment interest and significant payments begin upon a coin reaching the MS63 grade.

Data are based on completed Heritage Auctions and Stack’s Bowers trades.

Grade / Color | BN (Brown) | RB (Red-Brown) | RD (Red) |

MS63 | $40 | $60 | $115 |

MS64 | $65 | $95 | $185 |

MS65 | $145 | $210 | $375 |

MS66 | $280 | $450 | $650 |

Coins in MS66 RD grade occur significantly less frequently, provoking competition among buyers at major venues.

Record Sales and Peak Grades

Maximum prices for the 1902 penny are recorded for specimens possessing exceptional detailing and a total absence of field defects.

In 2021, a 1902 specimen in PCGS MS67+ RD grade was realized for 21,600 USD.

This price represents the absolute record for this mintage year.

A previous significant record was established in 2014, with a coin in MS67 RD grade being sold for 8,225 USD.

A 160% price increase over seven years for top grades confirms capital concentration in the segment of exceptional rarity.

In comparison, coins in MS65 RD condition grew in value by only 12–15% during the same period.

Population Statistics

Population reports from the coin appraisal app allow for calculating the probability of finding a coin in high quality.

Below are the data regarding the number of certified Red (RD) specimens.

MS66 RD: Approximately 230 pieces registered in total across both services.

MS67 RD: Only 19 specimens confirmed by experts.

MS67+ RD: Just 2 coins possessing this grade worldwide.

Such low population density in the highest categories ensures high lot value during rare market appearances.

Annual Value Change Dynamics

Market cycle analysis revealed the following price change trends in percentage terms.

Circulated Category (G-EF): Fluctuations within +/- 2% per year, correlating with copper prices.

MS63–MS65 Category: Average annual growth totaling 4.3% based on decade-long statistics.

MS66+ Category: Growth reaching 15–20% during periods of supply shortage at key auctions.

A price drop of 10–12% is observed for coins having hidden defects or questionable patina identified after opening the slabs.

Minting Errors Commanding a Premium

Technical production defects of 1902 are separated into a distinct price category.

The value of such specimens is not tied to standard grade tables.

Repunched Date (RPD). Repeated striking of the date digits.

A coin with a shifted digit "2" in AU condition can cost 60–90 USD compared to a base price of 35 USD.Misaligned Die. Offset of the obverse die relative to the reverse.

Minor offsets (up to 5%) add 10–15 USD to the price.Off-Center Strike. Planchet displacement during striking.

Specimens with a 15–20% offset are valued at 150–250 USD depending on date preservation.

The presence of a clearly expressed error allows for realizing the coin at a price exceeding its face value thousands of times.

Expertise Before Buying or Selling

A coin value app verification requires performing several checks excluding valuation errors.

Checking for the presence of all feathers in the Indian's headdress is mandatory for assigning a grade above VF-30.

The presence of four sharp letters in the word "LIBERTY" on the ribbon indicates Fine condition or higher.

Detecting cleaning traces in the form of parallel micro-scratches reduces the final payment by 70%.

Professional dealers always subtract commission (15–20%) and logistics costs from the market price when purchasing coins from individuals.

Asset Demand Forecast for 2026–2030

Market indicators suggest a stable position for the 1902 issue in the numismatic hierarchy.

Expected demand for the Red (RD) category remains high resulting from natural aging and copper darkening in old collections.

Prices for coins in MS65 RD grade may grow another 15–20% by 2030 assuming the continuation of current market absorption rates.

Common coins in Brown (BN) condition will remain affordable, representing no interest for investment capital growth.

Studying eBay realization facts shows that 85% of transactions are completed at prices not exceeding 20 USD.

For Investors

The 1902 penny is a liquid instrument having a clear division into consumer and investment sectors.

Actual payments from collectors are concentrated in the area of perfect preservation and certificate-confirmed grades.

Owning a coin without a professional assessment provides no guarantee of receiving a premium above minimum market values.

Only specimens possessing exceptional color and a minimum number of contact marks ensure record results at public trades.

Analyzing completed lots remains the only reliable way of understanding what a coin is actually worth at a specific moment in time.